Trading Strategies for Beginners

Trading Strategies for Beginners

Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective.

The Basics

Incorporate the invaluable elements below into your strategy.

- Money management – Before you start, sit down and decide how much you’re willing to risk. Bear in mind most successful traders won’t put more than 2% of their capital on the line per trade. You have to prepare yourself for some losses if you want to be around when the wins start rolling in.

- Time management – Don’t expect to make a fortune if you only allocate an hour or two a day to trading. You need to constantly monitor the markets and be on the lookout for trade opportunities.

- Start small – Whilst you’re finding your feet, stick to a maximum of three stocks during a single day. It’s better to get really good at a few than to be average and making no money on loads.

- Education – Understanding market intricacies isn’t enough, you also need to stay informed. Make sure you stay up to date with market news and any events that will impact your asset, such as a shift in economic policy. You can find a wealth of online financial and business resources that will keep you in the know.

- Consistency – It’s harder than it looks to keep emotions at bay when you’re five coffees in and you’ve been staring at the screen for hours. You need to let maths, logic and your strategy guide you, not nerves, fear, or greed.

- Timing – The market will get volatile when it opens each day and while experienced day traders may be able to read the patterns and profit, you should bide your time. So hold back for the first 15 minutes, you’ve still got hours ahead.

- Demo Account – A must-have tool for any beginner, but also the best place to backtest or experiment with new, or refined, strategies for advanced traders. Many demo accounts are unlimited, so not time restricted.

Components Every Strategy Needs

Whether you’re after automated day trading strategies, or beginner and advanced tactics, you’ll need to take into account three essential components; volatility, liquidity and volume. If you’re to make money on tiny price movements, choosing the right stock is vital. These three elements will help you make that decision.

- Liquidity – This enables you to swiftly enter and exit trades at an attractive and stable price. Liquid commodity strategies, for example, will focus on gold, crude oil and natural gas.

- Volatility – This tells you your potential profit range. The greater the volatility, the greater profit or loss you may make. The cryptocurrency market is one such example well known for high volatility.

- Volume – This measurement will tell you how many times the stock/asset has been traded within a set period of time. For day traders, this is better known as ‘average daily trading volume.’ High volume tells you there’s significant interest in the asset or security. An increase in volume is frequently an indicator a price jump either up or down, is fast approaching.

5 Day Trading Strategies

1. Breakout

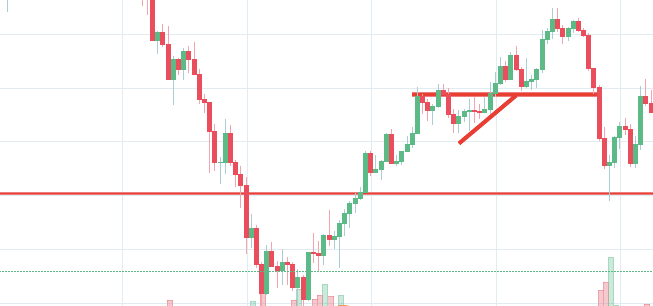

Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. The breakout trader enters into a long position after the asset or security breaks above resistance. Alternatively, you enter a short position once the stock breaks below support.

After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout.

You need to find the right instrument to trade. When doing this bear in mind the asset’s support and resistance levels. The more frequently the price has hit these points, the more validated and important they become.

Entry Points

This part is nice and straightforward. Prices set to close and above resistance levels require a bearish position. Prices set to close and below a support level need a bullish position.

Plan your exits

Use the asset’s recent performance to establish a reasonable price target. Using chart patterns will make this process even more accurate. You can calculate the average recent price swings to create a target. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Once you’ve reached that goal you can exit the trade and enjoy the profit.

2. Scalping

One of the most popular strategies is scalping. It’s particularly popular in the forex market, and it looks to capitalise on minute price changes. The driving force is quantity. You will look to sell as soon as the trade becomes profitable. This is a fast-paced and exciting way to trade, but it can be risky. You need a high trading probability to even out the low risk vs reward ratio.

Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. You can’t wait for the market, you need to close losing trades as soon as possible.

3. Momentum

Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. There is always at least one stock that moves around 20-30% each day, so there’s ample opportunity. You simply hold onto your position until you see signs of reversal and then get out.

Alternatively, you can fade the price drop. This way round your price target is as soon as volume starts to diminish.

This strategy is simple and effective if used correctly. However, you must ensure you’re aware of upcoming news and earnings announcements. Just a few seconds on each trade will make all the difference to your end of day profits.

4. Reversal

Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. It’s also known as trend trading, pull back trending and a mean reversion strategy.

This strategy defies basic logic as you aim to trade against the trend. You need to be able to accurately identify possible pullbacks, plus predict their strength. To do this effectively you need in-depth market knowledge and experience.

The ‘daily pivot’ strategy is considered a unique case of reverse trading, as it centres on buying and selling the daily low and high pullbacks/reverse.

5. Using Pivot Points

A day trading pivot point strategy can be fantastic for identifying and acting on critical support and/or resistance levels. It is particularly useful in the forex market. In addition, it can be used by range-bound traders to identify points of entry, while trend and breakout traders can use pivot points to locate key levels that need to break for a move to count as a breakout.

Calculating Pivot Points

A pivot point is defined as a point of rotation. You use the prices of the previous day’s high and low, plus the closing price of a security to calculate the pivot point.

Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced.

So, how do you calculate a pivot point?

- Central Pivot Point (P) = (High + Low + Close) / 3

You can then calculate support and resistance levels using the pivot point. To do that you will need to use the following formulas:

- First Resistance (R1) = (2*P) – Low

- First Support (S1) = (2*P) – High

The second level of support and resistance is then calculated as follows:

- Second Resistance (R2) = P + (R1-S1)

- Second Support (S2) = P – (R1- S1)

Application

When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. This is because a high number of traders play this range.

It’s also worth noting, this is one of the systems & methods that can be applied to indexes too. For example, it can help form an effective S&P day trading strategy.

Limit Your Losses

This is particularly important if you’re using margin. Requirements for which are usually high for day traders. When you trade on margin you are increasingly vulnerable to sharp price movements. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. Fortunately, you can employ stop-losses.

The stop-loss controls your risk for you. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. You can also make it dependant on volatility.

For example, a stock price moves by £0.05 a minute, so you place a stop-loss £0.15 away from your entry order, allowing it to swing (hopefully in the expected direction).

One popular strategy is to set up two stop-losses. Firstly, you place a physical stop-loss order at a specific price level. This will be the most capital you can afford to lose. Secondly, you create a mental stop-loss. Place this at the point your entry criteria are breached. So if the trade makes an unanticipated turn, you’ll make a swift exit..

Risk Management

Stop-loss

Strategies that work take risk into account. If you don’t manage risk, you’ll lose more than you can afford and be out of the game before you know it. This is why you should always utilize a stop-loss.

The price may look like it’s moving in the direction you hoped, but it could reverse at any time. A stop-loss will control that risk. You’ll exit the trade and only incur a minimal loss if the asset or security doesn’t come through.

Savvy traders don’t usually risk more than 1% of their account balance on a single trade. So if you have £27,500 in your account, you can risk up to £275 per trade.

Position size

It will also enable you to select the perfect position size. Position size is the number of shares taken on a single trade. Take the difference between your entry and stop-loss prices. For example, if your entry point is £12 and your stop-loss is £11.80, then your risk is £0.20 per share.

Now to figure out how many trades you can take on a single trade, divide £275 by £0.20. You can take a position size of up to 1,375 shares. That is the maximum position you could take to stick to your 1% risk limit.

Also, check there is sufficient volume in the stock/asset to absorb the position size you use. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss.

Comments

Post a Comment